Source: https://www.booklooks.org

Category: Uncategorized

Events

Upcoming Meet & Greets

Maxwell Creek (Saturday October 22nd)

- Where: Maxwell Creek Clubhouse (200 McCreary Rd., Murphy)

- Saturday October 22nd; 3 PM to 5 PM

A few of the obscene books that are already available in Wylie ISD libraries:

13 Reasons Why

Crank

Drag Teen

Me and Earl and the Dying Girl

l8r, g8r

The Black Friend on Being a Better White Person

The Other Talk: Our Reckoning with White Privilege

Abbie Glines Field Series

THE 4 BOOKS THAT HAVE ALREADY BEEN REMOVED FROM WYLIE ISD LIBRARIES:

The Bluest Eye

Lawn Boy

Tricks

Traffick (Sequel to Tricks)

WE WILL EDUCATE, NOT INDOCTRINATE, OUR CHILDREN

On This Page: Indoctrination

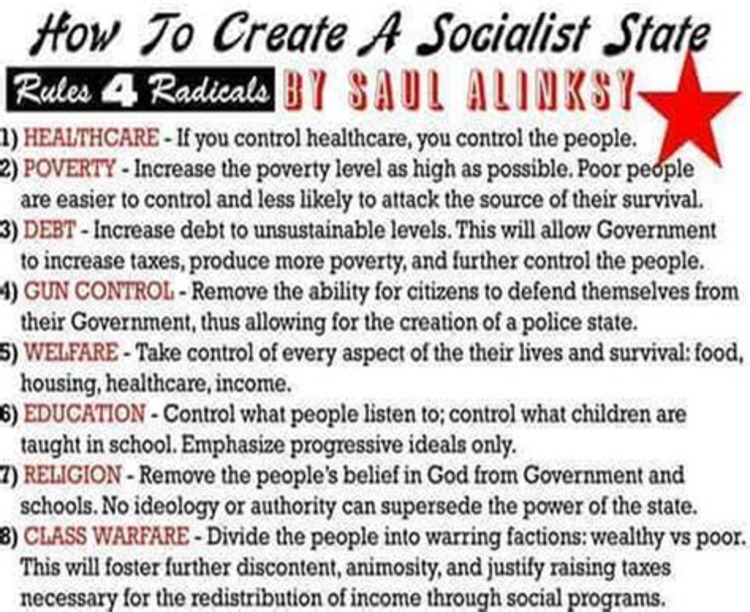

The Marxist indoctrination of students that began in our universities, including social justice, sexualization and gender fluidity, has now spread all the way down to the kindergarten level. Wylie ISD is no exception.

The Wylie ISD School Board has forgotten that schools exist to educate our children, not to be a laboratory for social and ideological indoctrination. We need strong leadership to combat the brainwashing of our children, and we must act NOW.

Is this “The Wylie Way” of educating our children?

- Superintendent David Vinson, in a June 9, 2020 blog post, posted a picture of himself kneeling beside students at the 2020 Wylie High graduation and also pushed the narrative of racial inequality and announced a Strategic Equity Plan

- Also in 2020, WISD made national news when a Cooper Junior High teacher included an image comparing the police to the KKK in an assignment. To the best of our knowledge, no disciplinary action was taken against the teacher, who is no longer employed by WISD as of August 2022. This incident provoked the following response from the National Fraternal Order of Police:

- WISD continues to purchase and place obscene books on school library shelves while the current trustees turn a blind eye to the issue, and when confronted, ignore the problem

- The Stonewall book awards is the self-proclaimed “first and most enduring award for LGBTQIA+ books. 11 of the 14 books that won the Stonewall Honor Books in Children’s and Young Adult Literature between 2017 and 2021 are in a Wylie ISD library.

- The Stonewall book awards is the self-proclaimed “first and most enduring award for LGBTQIA+ books. 11 of the 14 books that won the Stonewall Honor Books in Children’s and Young Adult Literature between 2017 and 2021 are in a Wylie ISD library.

- In August 2022, Groves Elementary held an afterschool event for all elementary students, including kindergartners, that featured a biography of an artist which included unnecessary information about his work promoting “social activism…racial equality and the LGBTQ community”

Indoctrination is already present within Wylie ISD schools. We need courageous leaders who are not afraid to take a stand and proactively eliminate all attempts to indoctrinate our children.

Our candidates believe in…

- Emphasizing a back-to-basics approach, with a focus on teaching children to think critically, analyze, and formulate using logic

- Preparing students to make a living and participate meaningfully in society as adults

- Teaching essential knowledge and skills in a neutral, politically agnostic environment that emphasizes facts over opinions

- Safeguarding the physical and mental well-being of students, faculty, and staff at all times

- Taking strong action against indoctrination, including social justice, sexualization, and gender fluidity, and any other subject that should be discussed at home, not at school

HOW WE GOT TO THE FINAL TAX RATE THAT WAS APPROVED FOR WYLIE ISD ON 8/15/22

Wylie ISD was provided their Estimate of Assessed Values in the Early Spring from the Collin County Central Appraisal District (CCCAD) and started the process for approving a tax rate for the coming year.

- On May 18, 2022, The Wylie ISD Administration provided a Form 50-859, Tax Rate Calculation Worksheet, to the Wylie ISD Board. The worksheet showed four key items:

- Line 20 showed 2022 Taxable Values of $9,004,829,584

- Line 23 showed estimated new revenue from new construction for $295,948,000 for 2022

- Line 25 showed the No New Revenue Tax Rate (NNR Rate) of 1.187812%

- Line 44 showed the Voter-Approval Rate (VA Rate) of $1.444800%

At the June 13, 2022 School Board meeting, given the above information, Wylie School Board once again voted unanimously, as they have 111 times consecutively, to approve the recommendation of Administration to levy a tax rate of 1.397900% for the coming budget cycle.

- Since this board was formed in November 2020, they have voted 111 consecutive times to unanimously approve whatever is suggested by Administration.

- This is where they earned the nickname of the “Rubber Stamp Board”.

- The 1.397900% tax rate is about 18% above the NNR Rate of 1.187812%. When they approved this rate at the

- This tax rate they voted to levy was necessary to fund the over $16.7M increase in the budget they approved at the same meeting. They refused to consider public requests asking them to instead approve the NNR Rate.

On July 25, 2022, the CCCAD provided FINAL Assessed Values which were about $500M below the estimated values provided in the Spring.

On August 1, 2022, The Wylie ISD Administration provided a revised Form 50-859, Tax Rate Calculation Worksheet, to the Wylie ISD Board. The revised worksheet showed four key items:

- Line 20 showed 2022 Taxable Values of $8,510,409,191

- Line 23 showed estimated new revenue from new construction for $301,242,946 for 2022

- Line 25 showed the No New Revenue Tax Rate (NNR Rate) of 1.259178%

- Line 44 showed the Voter-Approval Rate (VA Rate) of $1.397900%

At the August 15, 2022, School Board meeting, given the above revised information, Wylie School Board once again voted unanimously, yet again, to approve the recommendation of Administration to levy a tax rate of 1.397900% for the coming budget cycle.

- As the Final Assessed Values were about $500M below what was estimated, the NNR Rate rose from 1.187812% to 1.259178%. This is the new rate that would generate the same revenue based on the lower assessed value.

- The big change is that the Voter-Approval Rate was now lowered to 1.397900%, the rate the School Board had tentatively approved in the June meeting. This School Board approved the absolute maximum tax rate they could levy while avoiding an automatic election for voter approval.

Fallacies

- The Wylie ISD School Board voted to lower the tax rate. True but misleading! They have lowered the rate but not enough to offset the increase in Assessed Values. That would be the NNR Rate and they have NEVER chosen to utilize the NNR Rate. The below is an example of how lower tax rate against higher Assessed Values leads to higher property taxes – like Wylie ISD has done every year:

- $100,000 Assessed Value x 1.5% Tax Rate = $1,500 in Property Tax

- $130,000 Assessed Value x 1.4% Tax Rate = $1,820 in Property Tax.

- The Wylie ISD School Board only increase the tax rate 11% above the NNR Rate. True but misleading! The school board approved a rate at the June 13, 2022, school board meeting,1.397900%, that was 18% above the then 1.187812% NNR Rate. They approved the rate at that time knowing it was 18% above the NNR Rate and had no problem with that extreme increase. They would not listen to public comment asking them to reduce the rate at the August final rate approval meeting to the NNR Rate and instead confirmed the rate they approved in the June meeting. Just because the Assessed Values were lower than estimated and the final rate increase ended up being 11%, doesn’t negate the FACT they approved the rate when it was 18% above the NNR Rate. It’s disingenuous to claim that they were trying to minimize the increase. It’s simply spin.

- If Wylie ISD approves a NNR Rate, they will lose about $13M dollars. FALSE! It’s not a loss when you don’t TAKE more than you should from tax-payers. This mindset is at the core of the misguided thinking of Wylie ISD Administration and School Board. They forget that this is not their money!

- We have already shown that they had over $8.8M in excess revenue in the 2021-22 budget cycle and that they could expect to receive about $4.4M in tax revenue from new construction, which is almost $13.2M. The difference between revenue generated at the NNR Rate and the Voter Approval Rate they approved is about $11.387,920.

WHAT IS A NO NEW REVENUE TAX

RATE (NNR Rate)?

The No New Revenue Tax Rate (NNR Rate) is a rate that each taxing entity is required to calculate as part of their Tax Rate Calculation Worksheet – Form 50- 859 (for school districts)

- AFTER each taxing entity is provided their Estimated Assessed Values from the Collin County Central Appraisal District (CCCAD), They are must complete form 50-859(for schools), which provides an estimate of that taxing entities Adjusted Taxable Values they will use in finalizing their budget and setting their tax rate for the coming year.

- Line 25 of this form is where the NNR Tax Rate is shown on the form. This form also shows the Voter-Approval Tax Rate on line 44. Both rates are shown on the final page just above the name of the individual preparing the form as well as the applicable date.

What is the NNR Rate?

- The NNR Rate is the tax rate at which, when applied against Assessed Values, will yield approximately the same tax revenue as the previous year for existing commercial and residential property.

- The NNR Rate does not include tax revenue that would be generated from NEW construction of both commercial and residential properties.

- The estimate for the amount of new tax revenue due to the taxing entity.

- In 2021-2022, this amounted to approximately $4,397,544 in new revenue and would be expected to be about the same for the 2022-2023 tax year.

Fallacies

- No taxing entity can do a NNR Rate. FALSE! Both Collin County and the City of Wylie have voted to approve a No New Revenue Tax Rate for the past 6 and 5 years, respectively.

- If Wylie ISD approves a NNR Rate, they will lose about $13M dollars. FALSE! It’s not a loss when you don’t TAKE more than you should from tax-payers. This mindset is at the core of the misguided thinking of Wylie ISD Administration and School Board. They forget that this is not their money!

- We have already shown that they had over $8.8M in excess revenue in the 2021-22 budget cycle and that they could expect to receive about $4.4M in tax revenue from new construction, which is almost $13.2M. The difference between revenue generated at the NNR Rate and the Voter Approval Rate they approved is about $11.387,920.

HOW ARE TAX RATES SET BY TAXING

ENTITIES

THE ENTITIES

There are 4 taxing entities that together contribute to the Property Tax Bill you receive each year for the Wylie ISD Catchment Area

- The four taxing entities for Wylie ISD catchment area are Collin County, Collin College, Your city/Township (City of Wylie, City of Murphy, City of Sachse, St. Paul Township), and Wylie ISD.

- Some properties are in the Extra Territorial Jurisdiction (ETJ) and don’t have City Taxes. Others, like those living in Inspiration, may have up to 3 cities AND a Municipal Utility District (MUD) that are involved in their property tax bill.

- The process by which each entity sets their tax rate is pretty much the same regardless of the entity.

THE STEPS

Step 1 – Estimate of Assessed Values

- The Collin County Central Appraisal District (CCCAD) provides each taxing entity with an estimate in early Spring of where they are projecting that entities Assessed Values for their catchment area.

- Based upon the Estimated Assessed Values, the Wylie ISD Finance Department completed a Tax Rate Calculation Worksheet (Form 50-859) on 5/18/22 for Administration and the School Board that showed what they calculated the Adjusted 2022 taxable value would be for the upcoming budget cycle.

- They also provide the board with a NNR Rate, which is the rate at which the property tax revenue for existing property would stay approximately the same as the previous year and the Voter-Approval Tax Rate, which is the rate which if exceeded would automatically trigger an election for voters to approve the increase.

Step 2 – Budgets Set and Initial Tax Rates Are Set

- After each entity is provided their estimate of Assessed Values, they vote to approve their budget their tax rate for the coming year based on the estimated Assessed Values.

- Wylie ISD School Board Voted to approve both the budget for the coming tax year and their initial tax rate based upon those estimated Assessed Values at their June 13, 2022 Board Meeting.

- Step 3 – Final

Step 3 – Final Assessed Values are released by the CCCAD on July 25, 2022

- The Collin County Central Appraisal District (CCCAD) provided Wylie ISD with their final Assessed Values on 7/25/22.

- For some taxing entities, the final values are higher and for others the final values end up being lower.

- Wylie ISD Finance Department updated their form 80-859, mentioned above in STEP 1, which showed a revised NNR Rate and a revised Voter-Approval Tax rate as their Assessed Values ended up being less than originally estimated.

Step 4 – Vote to finalize the tax rate for the upcoming year

- Each taxing entity now must finalize their tax rate, based on the final Assessed Values, for their constituents by approximately the end of September. Each taxing entity is required to have a public meeting to take public comment about the new tax rate.

- Wylie ISD had this meeting on August 15, 2022 and approved a final tax rate of 1.397900%, which was the Voter Approval Tax Rate – the maximum rate they could levy without having an automatic election for voter approval.

FALLACIES CLARIFIED

- Taxes go up because the Assessed Values go up. NO, the taxes go up because the tax entity voted to increase taxes. It’s simple math, they know the value, agreed to a rate and that gives them the tax dollars.

- Taxes are set by the County. NO, as shown above, this process is the same for each independent taxing entity, including Collin County, Collin College, Every City and Wylie ISD. Each entity is in charge of the rate they levy and that rate is set AFTER they know the values of the property in their area.

- Wylie ISD has lowered their taxes every year. NO, they have lowered the rate but not enough to offset the increase in Assessed Values. That would be the NNR Rate and they have NEVER chosen to utilize the NNR Rate. The below is an example of how lower tax rate against higher AV leads to higher taxes – like Wylie ISD has done every year:

- $100,000 Assessed Value x 1.5% Tax Rate = $1,500 in Property Tax

- $130,000 Assessed Value x 1.4% Tax Rate = $1,820 in Property Tax.

REMOVE OBSCENE BOOKS FROM SCHOOLS

NO, IT’S NOT ABOUT BOOK BURNING!

- It is about exposing our children to materials that are OBSCENE and PERVASIVELY VULGER.

- It is about the over-sexualized, inappropriate books to which our children currently have access.

- It is about the lack of leadership by the Wylie ISD School Board by allowing NEW OBSCENE books to be purchased and added to our libraries while not showing urgency in dealing with the EXISTING OBSCENE books already in our libraries.

- It is about a School Board that refuses to insist Administration follow TEA standards to INCLUDE parents in this process.

- Finally, it is about a total lack of TRANSPARENCY about this issue and CONDENSCENSION and RIDICULE towards parents that ask questions!

All you hear on social media when the issue of obscene books in our libraries is raised are the rants about how this really just about banning or burning books and that anyone who requests a review of obscene books in our libraries must be ridiculed, vilified and malicious intent must be assigned to those who question. It reminds you of grade school bullying at it’s worst, but now it is parents doing the bullying.

How did this become such a major issue?

If you are interested in learning how we got to his point, then click HERE and learn how this has been building for almost 9 months due to a poor leadership, poor communication, non-existent transparency and refusal to follow either Wylie ISD guidelines or TEA standards on this issue.

EXAMPLES:

Some have said: “this is just a bunch of book banners/burners. Obscene books don’t exist in our Wylie ISD libraries.” The following link presents seven books with excerpts. We will show you 100% proof there are obscene books currently in our school libraries. We also share the four books that were quietly removed after we brought attention to them.

VIEW OBSCENE CONTENTTHIS BEGS THE QUESTION – HOW DOES ONE DEFINE OBSCENE?

The best place to start is by looking at what the State of Texas legally considers as obscene by what is codified in the Texas Penal Code. Texas Penal Code 43.24 Sale, Distribution, or Display of Harmful Material to Minor (excerpted below) (Read the full code HERE.)

- Code 43.24 defines harmful material as follows:

(2) “Harmful material” means material whose dominant theme taken as a whole:

- (A) appeals to the prurient interest of a minor, in sex, nudity, or excretion;

- (B) is patently offensive to prevailing standards in the adult community as a whole with respect to what is suitable for minors; and

- (C) is utterly without redeeming social value for minors.

- While this portion of the code clearly defines what is obscene, unfortunately, the current code includes an affirmative defense to prosecution under this section for the exhibition by a person having educational justification.

- This means you could be arrested if you were to possess something that violated this code, but if it’s in the school library or in a teachers library, they currently have an affirmative defense from prosecution.

This is a parent at a School Board in January of this year asking “When did we set the bar so low?”

IS THERE A SUPREME COURT DECISION THAT PROVIDES INSIGHT?

YES, the 1982 Supreme Court decision Board of Education vs. Pico is considered the primary guidance on this issue.

- Key points in this ruling:

- School Boards may not remove books based on “narrowly partisan or political grounds”.

- School boards may remove books if they are deemed to be “PERVASIVELY VULGAR”

- When it comes to books with STRONG SEXUAL THEMES, “courts have told public officials at all levels that they may take COMMUNITY STANDARDS into account when deciding whether materials are OBSCENE or PORNOGRAPHIC and thus subject to censor.”

Dr. Spicer and the committee she put together – NO PARENTS ALLOWED – for reviewing books uses the subjective standard of “PERVASIVE VULGARITY”. As they review books, they will only remove a book if 2/3 of her secret committee decides the book is OVER 50% PERVASIVELY VULGAR!

The question is…

Are you comfortable with this level of/lack of transparency?

Are you comfortable with books being in the library that are “ONLY” 49% pervasively vulgar?

SO, WHAT IS THE SOLUTION?

Since materials available to our children, whether in a school library or classroom library, may be held to a standard, how is that done?

The School Board will need to have extreme courage to withstand the fire storm of activists that want to push a social ideology on our children, regardless of age.

Two tactics have been utilized by ISD’s here in Texas:

- Review books and remove those considered inappropriate

- This is the strategy utilized by Granbury ISD

- Granbury ISD pulled 131 books from the shelves for review and ended up returning 116 back to the shelves

- This is the strategy utilized by Granbury ISD

- Review books and put objectionable books that violate School Board policy into a separate section in the library requiring parental approval for viewing or check-out.

- This is the strategy utilized by Katy ISD, Keller ISD and Grapevine-Colleyville ISD.

Our solution is a hybrid of all three solutions. The initial step a courageous School Board would need to take is to commit to reviewing books that are submitted for review, whether a list or individually, and doing so in a transparent way. The School Board could create a committee that includes PARENTS, perhaps something like our SHAC committees, to enhance transparency and parental inclusion, as required by TEA.

- The School Board would need to rewrite the rules surrounding how books are reviewed, both new books being purchased and existing books that have already been purchased and are currently in our libraries.

- This would include both the school libraries and classroom libraries.

There are at least 3 possible outcomes for books that are reviewed:

- Outcome 1 – Some books will need to be removed if they are found to be “Pervasively Vulgar”, Obscene (per Texas Penal Code 43.24) or violate Community Standards.

- Though done in a haphazard disorganized way, Administration has already shown books can be removed by removing “The Bluest Eye”, “Lawn Boy”, “Traffick”, “Tricks”, and supposedly several other books. It took them 9 months, and they tried to hide it. Why?

- Outcome 2 – Set up a section of each library of books that require Parental Consent to check-out.

- This is for books that fall between being removed and put back on the shelf.

- Outcome 3 – Put the book back on the shelf

- IF there is disagreement with the findings of the Committee, they could appeal the decision to the School Board. The School Board would review the book in question and have a public vote as to the outcome for that book.

We would also encourage the administration to set up a system to, at parent request, notify them of any books checked out by their children. This would help insure parents are aware of books being read as well as help cut down on lost or late books

The bottom line is we need a school board that is courageous enough to expedite thereview and/or removalof books that are obsceneand include parents and teachers in the review process.

ARE THERE LISTS OF BOOKS TO BE REVIEWED?

- There are many lists out there of questionable books. Originally, the list provided to Wylie ISD Administration in January 2022 was for the list of books reviewed by Granbury, ISD.

- There are a group of parents who have put together a list of books they would like reviewed that they have confirmed are in Wylie ISD school libraries. See it HERE

- Here are a few of the other lists of questionable books that exist.